Whenever I meet foreign entrepreneurs, there is one question that always pops up: ‘How much Singapore income tax will I pay here as a foreigner?’

It’s a great question, and it shows just how savvy you are about getting your business off to a strong start.

Let me break down what you need to know about Singapore income tax for foreigners that is easy to understand.

Know your income tax obligations

In Singapore, whether you’re a local or a foreigner, resident or non-resident, setting up your company means you’re self-employed.

This includes earning your income through any trade, business, profession, or vocation you run.

Being self-employed specifically refers to being a sole proprietor or a partner in a partnership. It’s important to note that this doesn’t include being a director or shareholder of a private limited or limited company.

Other examples of self-employed persons are freelancers, private-hire car drivers, home bakers, and so on.

The money you make from your business in Singapore (SG) is considered business income, not salary. It’s added to any other personal income you have, and the total amount is taxed based on individual tax rates.

The individual tax rates are determined based on your tax residency status.

What does a tax resident mean?

There are various scenarios to this question. Let me explain them below.

Non-Resident status: Setting up an SG Company while living abroad

Imagine you’re a foreign entrepreneur who has just set up a company in Singapore.

You might think that incorporating here automatically makes your company a tax resident, but there’s more to it.

- Control and Management – Key management decisions for your company must be made in Singapore, often indicated by where the board of directors meetings are held.

- Company structure/Entity – Whether it’s a private limited company, a partnership, or any other structure, you can only be a tax resident if you make crucial decisions in Singapore, and meet the control and management criteria.

However, it’s always good to remember that each case can be unique, and other factors might also play a role in determining tax residency.

SG Company setup with work visa: Tax residency for extended stays

If you’re a foreigner and start a business as a sole proprietor or in a partnership, your company’s tax residency depends on where you or your partners personally live and work most of the year.

Therefore, your personal residency status as an individual will determine your company’s tax residency.

You will be treated as a tax resident for a particular Year of Assessment (YA) if you’ve:

- Lived or worked in Singapore for at least 183 days in the previous year.

- Been here continuously for three years.

- Worked in Singapore for over two years, and your total stay is at least 183 days (this doesn’t count if you’re a company director, a public entertainer, or a professional).

Based on these criteria, as a tax resident, you must file your income with the Inland Revenue Authority of Singapore (IRAS) as a self-employed person.

For detailed guidance on how to do this, you can check out the filing responsibilities for tax residents.

Taxable rate for tax residents

Here’s what you need to know to meet the conditions for tax residency:

All your income earned in Singapore will be taxed.

The income you make from other countries and bring to Singapore will not be taxed (except for certain partnerships in Singapore).

You can reduce your taxable income with deductions for expenses, donations, and personal relief.

After these deductions, your remaining income is taxed at progressive rates from 0% to 22%, depending on how much you earn.

The table below provides the current tax rates for individual income at various income brackets:

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

| First $20,000 Next $10,000 | 0 2 | 0 200 |

| First $30,000 Next $10,000 | – 3.50 | 200 350 |

| First $40,000 Next $40,000 | – 7 | 550 2,800 |

| First $80,000 Next $40,000 | – 11.5 | 3,350 4,600 |

| First $120,000 Next $40,000 | – 15 | 7,950 6,000 |

| First $160,000 Next $40,000 | – 18 | 13,950 7,200 |

| First $200,000 Next $40,000 | – 19 | 21,150 7,600 |

| First $240,000 Next $40,000 | – 19.5 | 28,750 7,800 |

| First $280,000 Next $40,000 | – 20 | 36,550 8,000 |

| First $320,000 Next $180,000 | – 22 | 44,550 39,600 |

| First $500,000 Next $500,000 | – 23 | 84,150 115,000 |

| First $1,000,000 Above $1,000,000 | – 24 | 199,150 |

Data: From YA 2024 onwards – IRAS

Important note: Starting in the 2024 tax year, if you’re a Singapore tax resident earning over S$500,000 a year, here’s what changes for you:

The part of your income between S$500,000 and S$1 million will be taxed at 23%. Any income above S$1 million will be taxed at a higher rate of 24%.

Non-tax resident in Singapore

If you don’t meet the residency conditions mentioned earlier, you’ll be considered a non-resident for tax purposes in Singapore.

This is particularly relevant if you, as a business owner, manage your Singapore business remotely or frequently travel in and out of the city.

In this case, you’re not entitled to tax relief, and this rule applies to employment pass holders as well.

Your income will be taxed at either a flat rate of 15% or the progressive resident rate, whichever is higher.

Also, if you’re a non-resident director, there are specific tax obligations you should be aware of. For more detailed information, you can visit the IRAS website.

Essential points of the Singapore income tax system

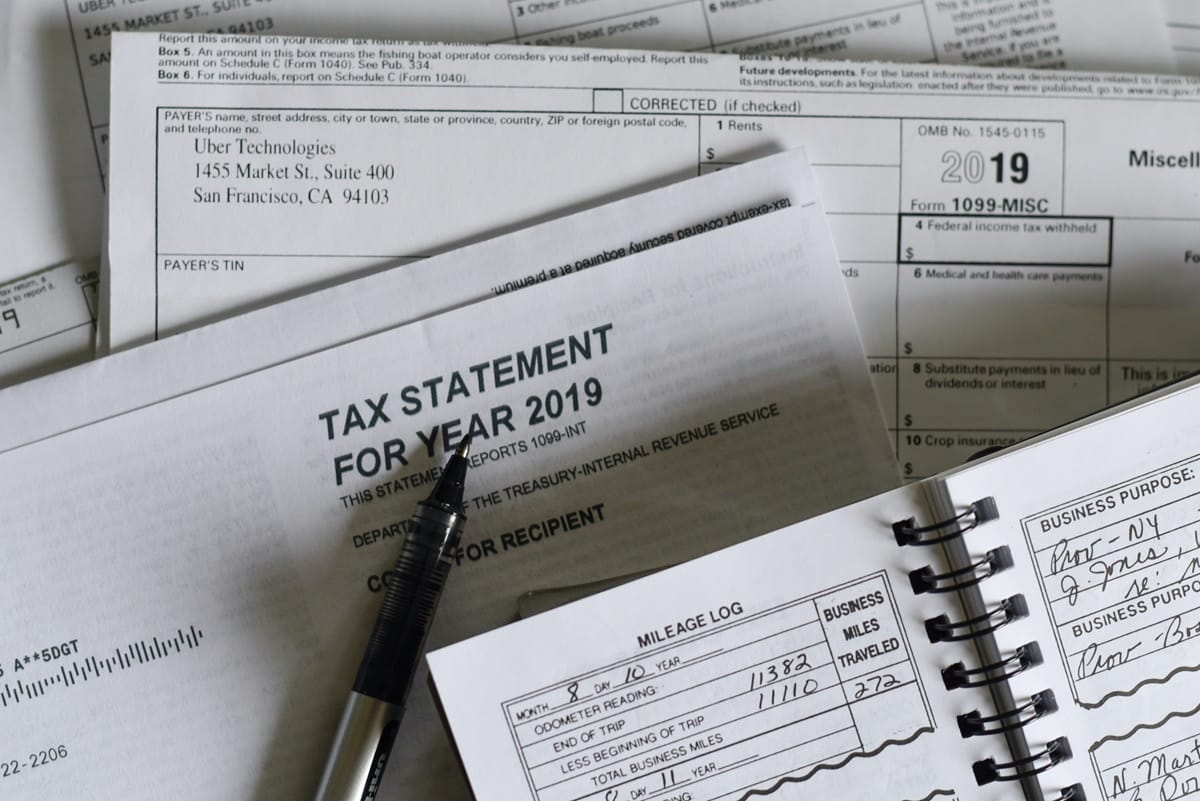

Here are some vital points to remember when you’re filing your income tax return in Singapore.

Income tax in Singapore is based on net income

This means you take your total (gross) income and subtract any allowable expenses and reliefs to find the amount you’ll be taxed on.

Tax assessment

Your income tax is based on the income you earned in the previous year. For instance, the income you earn from January 1 to December 31, 2023, will be assessed in 2024.

You need to file your taxes by April 15 each year.

Income not taxed

- You don’t pay tax on capital gains, like when you sell property, stocks, or business assets.

- Dividends from Singapore companies, and sometimes from Hong Kong and Malaysia, aren’t taxed.

- There’s no inheritance tax on assets you inherit.

Corporate income tax

Setting up your SG company comes with an important consideration for tax residency status and its benefits.

As key holders, ensure you conduct your Annual General Meeting (AGM) or Board of Directors meeting physically in Singapore at least once a year.

This demonstrates that the control and management of your company are firmly rooted in Singapore.

Keep in mind that the corporate tax rate is 17%, but eligible companies can access various tax benefits, exemptions, and rebates to reduce their tax burden.

This is one of the aspects that makes doing business in Singapore financially attractive.

Personal income tax filing

If you earn S$22,000 or more in a year, remember to file your personal income tax return by April 15th using paper forms, or by April 18th for e-filing.

Even if you didn’t earn anything, you still must declare this by filling out a tax form. Just log into the myTax portal to use the right forms.

Paying your taxes in Singapore

The preferred and most convenient mode of payment for taxes is online. Here are the common methods:

- GIRO: This is a popular choice for its convenience. You can arrange for monthly deductions from your bank account to pay your taxes. This can be set up through myTax Portal.

- Internet banking: You can pay your taxes through the bill payment service offered by most major banks in Singapore. Just log in to your bank’s internet banking platform.

- AXS: Payments can also be via AXS stations, AXS e-station online, or through the AXS mobile app.

- Credit card: You can use credit card payment services through third-party platforms like CardUp, ipaymy, or SAM kiosks.

- Telegraphic transfer: For those outside Singapore, telegraphic transfer is an option, but note that bank charges may apply.

Final thoughts for foreign entrepreneurs on Singapore’s income tax

Bringing your business to Singapore or starting a new one is always a big step, and understanding taxes is a crucial part of your journey.

I like to think of Singbac as more than just a service provider; we’re your partner in this exciting adventure.

We’re committed to helping you make informed decisions that pave the way for your business’s success in our vibrant city.

Whether you’re setting up a trading office for your agri-commodity business, launching an e-commerce platform, kickstarting a delivery or cleaning service, or even bringing a brilliant startup idea to life, Singbac is here to guide you every step.

We understand that each business has its unique challenges and opportunities, especially in a dynamic environment like Singapore.

From navigating regulatory requirements to optimizing your operational strategies, we provide the comprehensive support you need to thrive.

Our expertise ensures your venture receives the right tools and insights to succeed.